IAS 12 prescribes the accounting treatment for income taxes, including the recognition of current and future tax consequences from various transactions, as well as the future recovery of assets and settlement of liabilities.

For companies applying IFRS for SMEs, Section 29 Income Taxes is relevant and prescribes an accounting treatment similar to IAS 12.

Accounting Profit vs. Taxable Profit

In the context of this standard, accounting profit is defined as profit before tax, while taxable profit or loss is determined according to applicable tax rules.

Differences frequently arise between accounting profit and taxable profit, which can include:

Income or expenses recognized in profit and loss but not taxable/deductible:

Example 1: Interest income is recognized when earned but is taxable only upon receipt.

Example 2: Research expenses are included in profit and loss but are deductible for tax purposes in a later period.

Example 3: Fuel expenses are included in profit and loss but are only partially deductible for tax purposes.

Expenses or income not recognized in profit or loss but are taxable/deductible:

Example 4: A 100% capital allowance for plant and equipment is available for tax in the year of purchase, while the expense is spread over the asset's useful life in profit and loss.

Adjustments to reconcile accounting profit with taxable profit:

Example 5: Entertainment expenses included in profit and loss but not deductible for tax purposes. This creates a permanent difference affecting current tax only, with no deferred tax implications, as there are no future tax consequences.

Current Tax vs. Deferred Tax

Current tax is payable on taxable profit for the period to the tax authorities.

Journal Entry:

Dr. Income tax expense in P&L or OCI (if tax is due to items of OCI) or Equity (for prior period adjustments)

Cr. Tax Liability

Taxable Loss:

Unused tax losses and credits are recognized as a Deferred Tax Asset in the statement of financial position only to the extent that it is probable future taxable income will be available to offset this asset.

Deferred Tax is an accounting measure used to account for temporary differences between the carrying value and tax base of assets and liabilities (Deferrd tax is essentially an accrual for tax to normalize the effects of income tax due to temporary timing differences). It does not impact the income tax payable to tax authorities and is calculated as the difference between the carrying amount of assets and liabilities and their tax base, multiplied by the applicable tax rate.

Deferred Tax Liability (DTL): If the carrying amount > tax base

Cases where DTL is not recognized:

- Initial recognition of goodwill in a business combination.

- Transactions that affect neither accounting profit nor taxable profit.

- Liabilities from undistributed profits where the entity can control the timing of the reversal and it is unlikely to occur in the foreseeable future.

Deferred Tax Asset (DTA): If the carrying amount < tax base

Deferred Tax Assets are recognized only if future taxable profits will be available to utilize the deferred tax assets.

Tax Base

The tax base is the amount attributed to an asset or liability for tax purposes.

For assets: It is the amount deductible against any taxable benefits, i.e., the amount remaining to claim in the future.

For liabilities: It is the carrying amount minus the amount deductible for tax in future periods, i.e., what is available for deduction in future tax returns.

Temporary Differences

Temporary differences arise from differences between the carrying value and tax base of assets and liabilities, leading to deferred tax (excluding unused tax credits and tax losses).

Example 1: A property costing $100,000 has had $80,000 claimed in previous tax returns, leaving a tax base of $20,000. If accumulated depreciation on the books is $65,000, the carrying value is $35,000. The temporary difference is $15,000 ($35,000 - $20,000). Assuming a tax rate of 30%, the deferred tax is $4,500, resulting in a Deferred Tax Liability (DTL) of $4,500.

Example 2: An R&D expense of $50,000 is incurred but not claimable until a future date, making its tax base $50,000. Since the R&D expense is not on the balance sheet, its carrying value is zero. Thus, the temporary difference is -$50,000 ($0 - $50,000), resulting in a Deferred Tax Asset (DTA) of $15,000 ($50,000 at a 30% tax rate).

Effects of Tax Rate Changes

Deferred tax is recognized based on the enacted or substantially enacted tax rate applicable in the future, not an estimated rate.

Recognition of Deferred Tax

The accounting for deferred tax mirrors that of current income tax.

If DTL:

Dr. Income tax expense in P&L or OCI (if tax is due to items of OCI) or Equity (for changes directly in equity)

Cr. Deferred Tax Liability

If DTA:

Dr. Deferred Tax Asset

Cr. Income tax income in P&L or OCI (if tax is due to items of OCI) or Equity (for changes directly in equity)

Note 1: In a business combination, deferred tax impacts goodwill.

Note 2: For group accounts, fair values at acquisition are used instead of carrying values for temporary difference calculations.

Offsetting

Can current income tax assets and liabilities be offset?

Yes, if two conditions are met:

1. The entity has a legal right to offset (the tax authority is the same and permits offsetting).

2. The entity intends to settle on a net basis.

Can deferred tax assets and liabilities be offset?

Yes, if:

1. Current tax assets and liabilities can be offset.

2. Deferred tax assets and liabilities relate to the same tax authority.

Deferred Tax on Investments in Associates, Joint Ventures, and Subsidiaries

For undistributed profits, foreign exchange charges, and reductions to recoverable amounts, recognize a deferred tax liability due to timing differences, unless the parent can control the timing of reversals or non-reversals are probable.

For Deferred Tax Assets on investments, recognize only if:

- The reversal is foreseeable in the future.

- Taxable profits are available.

Disclosures

IAS 12 requires several disclosures, including:

- Major components of tax, such as current tax and deferred tax.

- Amount of income tax related to and charged to OCI & equity.

- Explanation of changes in income tax rates.

- Reconciliation of theoretical tax expense (accounting profit x tax rate) and total tax expense.

Income Tax and Deferred Tax in Practice

To prepare an income tax reconciliation, the following documents and schedules are required:

- Statement of financial position.

- Statement of profit and loss and other comprehensive income.

- Income tax return (or detailed calculation of current income tax).

- Detailed calculation of the deferred tax asset or liability as of the end of the previous reporting period.

- Detailed calculation of the deferred tax asset or liability as of the end of the current reporting period.

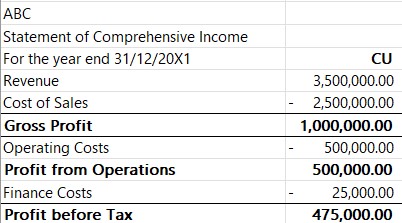

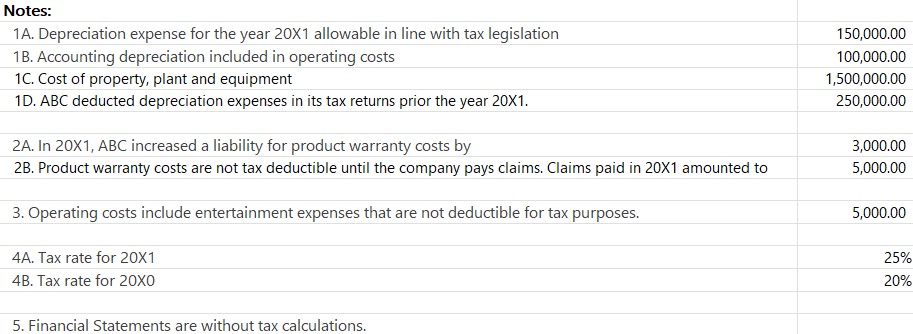

Example

STEP 1: Current Income Tax Calculation

Accounting Profit | 475,000 | |

Add back: Accounting Depreciation Entertainment expenses Product Warranty Provision

| 100,000 5,000 3,000

| 108,000 |

Less: Tax depreaication Wannaty claims paid

| 150,000 5,000

| (155,000) |

Taxable Profit | 428,000 |

STEP 2: Current Year Deferred Tax Calculation

Item | Carrying Value | Tax Base | Temporary Difference | Deferred Tax @ -25% | Type |

Property, plant and equipment *Cost less perior and current yeartax depreciation) | 1,000,000 | 1,100,000 (1,500,000 - 250,000-150,000)* | -100,000 | 25,000 | DTA |

Trade Receivable | 500,000 | 500,000 | 0 | 0 | |

Inventories | 150,000 | 150,000 | 0 | 0 | |

Product Warranty Provision * Tax base in zero as provision is not allowable for tax. | -10,000 | 0* | -10,000 | 2,500 | DTA |

Trade Payable | 250,000 | 250,000 | 0 | 0 |

Net Deferred Tax Asset 20X1: 27,500 (25,000 + 2,500)

STEP 3: Prior Year(s) Deferred Tax Calculation

Item | Carrying Value | Tax Base | Temporary Difference | Deferred Tax @ -20% | Type |

Property, plant and equipment *Current year carrying value tax depreciation ** Cost less prior years tax depreciation | 1,100,000* | 1,250,000** | -150,000 | 30,000 | DTA |

Product Warranty Provision | -12,000 (10,000 - 3,000 + 5,000) | 0 | -12,000 | 2400 | DTA |

Deferred Income Tax Income (Increase in DTA) | 2,400 - 2,500 | -100 |

Deferred Income Tax Expense (Decrease in DTA) | 30,000 - 25,000 | 5,000 |

Total Deferred Income Tax Expense | 4,900 | |

Total Income Tax Expense | 107,000 + 4,900 | 111,900 |

STEP 4: Income Tax Reconciliation

Tax on accounting profit of 475,000 @ 25% | 118,750 |

Tax impact of disallowed expenses 5,000 x 25% | 1,250 |

Tax Impact on deferred tax due to tax rate change 32,400 x (1 - (25% / 20%)) | -8,100 |

Total Income Tax Expense | 111,900 |

Further Resources

IFRS Navigator Conceptual Framework

The above links are to ifrs.org. To access the standards, log in or create a free account

Deloitte IFRS learning CPD Box: Income TaxesCPD Box: Tax Reconciliation CPD Box: Tax Basis CPD Box: Deferred Tax